A 39,000 increase in government hiring boosted the payroll figures. The gain in private employment, 58,000 workers, was the smallest since October 2005.So there you have it. Be happy with 97,000. We might soon be longing for these glory days.

Friday, March 09, 2007

97,000 New Jobs Now Good Enough

Saturday, October 29, 2005

3.8% GDP Growth Diddly Squat to Consumers

The Associated Press's Ron Fournier writes,

The economy has been a baffling issue to Bush and his team. They have not figured out how to convince the public that the economy is doing as well as experts say. It's a hard sell when pension funds are going bankrupt, health care costs and gasoline prices are soaring and jobs are being shipped overseas.

That is, policymakers wonder why even with 3.8% GDP growth are consumers still rather glum. The US economy isn't doing nearly as well as the GDP figure indicates, and consumers should be worried:

(1) Wealth redistribution is going the wrong way - primarily because of misguided income tax, estate tax and capital gains policies, money is going from the pockets of those with less to those with more. Add in surging energy costs which have similar redistribution effects and you can see why Joe Consumer isn't happy.

(2) Consumers are getting squeezed no matter what - do the math...falling incomes and greater expenditures doesn't sound like a recipe for cheerful consumers. Now, the happy talk people might say that the evidence shows consumers are still spending like crazy, so don't worry,

I'll offer two counterarguments, though I suspect there are many more. First, consumers might be loading up on debt now in anticipation of higher interest rates. If the Fed has telegraphed this point clearly, then it would seem to be a "logical" thing to do now to buy flat screen TVs and take out mortgages on dream homes before interest rates head north. The principle is the same as the ridiculous "Employee Discount" promotion that automakers used to shoot themselves in the feet. Consumers are bringing expenditures forward to take advantage of current favorable conditions, so why buy tomorrow when things aren't as favorable? We'll see.

Second, consumers have no real choice in many instances. At the end of the day, you still need to put food on the table, put gas in the car and all that stuff. Sure, they're able to stomach higher prices for a while, but just how much consumer dissavings can they sustain? The tougher bankruptcy laws (passed at the behest of the finance industry) have definitely lowered the pain threshold for consumers, and we're likely to see fallout in the coming months.

(3) Debt needs to be paid - this might be ridiculously obvious, but the free lunch economists seem to ignore this point altogether. Sure you can borrow a lot now at historically low interest rates, but where will you get the money to pay it off in the future while wages are stagnant and prices are rising? Dissavings can only get you so far, and that margin of safety is rapidly shrinking.

(4) GDP is an imperfect measure of economic progress - it hides the deleterious effects of debt in many instances. So, you can induce spending to the high heavens in vain pursuits like housing and unlimited consumerism, but of course it misses the earlier point. You can have your cake and eat it too at the moment, but all debts must be paid in full when tomorrow comes, and GDP doesn't account for that.

Monday, October 24, 2005

Bernanke Hanky Panky

Markets seem to be rather overjoyed that the Greenspan-lite choice to replace "The Maestro" is none other than Ben Bernanke. The main difference between him and Greenspan is that he has a more favorable view of inflation targeting. (The much-maligned EU does pretty much the same.) What is more worrisome is what the markets seem to like--that he is much alike Greenspan. The soon-t0-be retired Fed Chairman has, in recent years, barely raised objections as budget and current account deficits have spiraled out of control while belatedly acknowledging the presence of froth in parts of the housing market.

Markets seem to be rather overjoyed that the Greenspan-lite choice to replace "The Maestro" is none other than Ben Bernanke. The main difference between him and Greenspan is that he has a more favorable view of inflation targeting. (The much-maligned EU does pretty much the same.) What is more worrisome is what the markets seem to like--that he is much alike Greenspan. The soon-t0-be retired Fed Chairman has, in recent years, barely raised objections as budget and current account deficits have spiraled out of control while belatedly acknowledging the presence of froth in parts of the housing market.So, what matters most will be his ability to get these "twin deficits" under control, and particularly to induce a "soft landing" from the "Bretton Woods II" system of American debt lust. If he sticks to a Greenspanesque course without demanding concrete improvements on these fronts, the folly of Greenspan's actions in the Dubya era will come to fore during his term.

As The Who once sang, "Meet the new boss--same as the old boss!"

Thursday, October 20, 2005

Dumb Enough to Buy Stocks?

Today's 133 point drop in the Dow Jones Industrial Average (DJIA) is no surprise to hardcore bears like myself. What's more surprising is that the DJIA rose 128 points the day before. Now, explanations for this (deviant) behavior can be offered:

Today's 133 point drop in the Dow Jones Industrial Average (DJIA) is no surprise to hardcore bears like myself. What's more surprising is that the DJIA rose 128 points the day before. Now, explanations for this (deviant) behavior can be offered:(1) Bottom-picking: Those bargain-hunters who were looking for bargains seem to have reversed their (inscrutable) logic the day after. Honestly, the bottom hasn't fallen out of the sky just yet. A sustained drive below 10,000 or worse on the Dow looks quite likely, given that maybe only true believers of Cheneynomics are still under the illusion that this is the best economy of our lifetimes. Hallucinogens are such wonderful investment aids--as long as you're not interested in making money.

(2) False expectations: Again, some people are prone to taking a few positive signals and concluding that everything's going to be alright. So what if GM had another round of miserable earnings. They were coming to terms with the UAW, dammit. So what if Intel didn't see things looking so profitable going forward. Oil prices were falling, dammit. People have an almost endless capacity for self-delusion. Too bad that the next day, Ford decided to do a GM and report losses together with additional layoffs. On top of that, Pfizer got Mercked into reporting underwhelming sales. Even the rather useless and inaccurate Conference Board leading economic indicator index fell by 0.7%. All is not well in Greenspan's Bubbleland, and things are bound to get worse once he abdicates his throne and the lemmings start worrying.

(3) Faith-based investing: Don't worry, Mr. Investor. The "Chosen One" Bush will pump prime the economy after Wilma naturally juices all the oranges in Florida. Don't be so damn negative; spend all you've got and everything will be alright. You can have your cake and eat it too. To paraphrase Kennedy, why save for tomorrow what you can spend today? It's no pain, all gain in this rosy Bushworld. Reality is such a nuisance.

Friday, October 14, 2005

Go Consumer, Go!

Out here in Arizona close to New Mexico

In the barren desert near the Navajo

There stood a McMansion made of steel and wood

Where lived a city slicker named Johnny B. Lewd

Who never learned to save or budget so well

But he could splurge on credit really damn swell

Years from now, the US consumer of the early 21st century will be studied by anthropologists, and they will laugh oh-so-hard at his manically illogical behavior. His spending accounted for nearly 70% of the US economy, buying up everything with little regard for anything else. He took particular delight in selling houses to his peers with money borrowed from the Chinese, and this unproductive behavior accounted for about 40% of all job creation after the semi-apocalyptic events of September 11, 2001. In addition to houses, he bought far more than he needed, and even borrowed against the value of his home(s) to get more money to spend himself silly.

These anthropologists will perhaps note October 14, 2005 as a pivotal moment in the devolution of Spendthriftus Americanus. He spent well beyond his means, pretty much oblivious to everything going on around him including global fundamentalist religious conflict, twin deficits, major calamities, corporate malfeasance, and US-led wars of convenience. On this day, though, his limited capacity for understanding the world around him was awakened to a greater degree than usual. His weekly take-home pay fell 1.2% while consumer price inflation rose 1.2% (the biggest advance in half a century), meaning that he had less money to spend on essentials like iPod Videos and Paris Hilton home movies.

In a semi-climatic episode, he began to shout at the devil: "Why the #$@% am I running out of money? I am the consumer--the King of America!" The reply was quick in coming. The devil said, "Well, sonny, it's the end of free money. The Demon-Fed needs to cut down on the nonsense they've created in the first place, and it doesn't particularly care that personal bankrupties and consumer dissavings are at an all-time high." Spendthriftus Americanus was horrified as the devil let out a demented laugh and said he had to go collect Karl Rove's black heart or something to that effect then vanished in a great ball of fire. Bemoaning his lot, the consumer's confidence hit its lowest point in 13 years at 75.4. In his heart of hearts, he knew that the party was very nearly over and cried himself to a fitful sleep.

Good Job on Those Employee Discounts

(1) Automakers depress resale values by offering discounts piled on top of incentives piled on top of discounts. As long-term ownership propositions, the money "saved" by buying these cars at fire-sale prices is lost because their resale values are markedly diminished.

(2) Brand equity is lost. What kind of pride of ownership is there in owning makes that are enthusiastically being hawked like fake Rolexes on Main Street? Shame is the name of the game.

(3) Sales were moved ahead by these discounts. Now that the promotions are gone, the bargain-seekers are too.

(4) By offering these discounts, consumers are conditioned to look forward to more giveaways. If US automakers treat sticker prices like a running gag, then consumers will too.

The end result is rather terrible for domestic automakers:

Retail new-vehicle sales were down 33 percent across the industry in the first nine days of October compared with the same period a year ago, the Power Information Network said.Meanwhile, those not dumb enough to follow suit are suffering less, as expected:It said results were down at nine major automakers, but GM led the pack with a 57 percent decline followed by Ford, which saw its retail sales drop 45 percent over the first nine days of the month.

The Chrysler arm of Germany's DaimlerChrysler posted a 32 percent drop over the same nine-day period compared with year-ago results.

The long-predicted demise of GM, like that of its Delphi affiliate, will not be too far away if it can't come up with products more in tune with the times, like really usable hybrid vehicles. Ford is in somewhat better shape, but isn't turning the ship around by any means. Why they stick to a strategy of lowballing massive SUVs few really want is beyond all reason.The U.S. arm of Honda Motor Co. Ltd. posted the smallest drop, with retail sales down just 8 percent, followed by Toyota Motor Corp., with sales down 14 percent.

Sunday, October 09, 2005

Crusader Advertising, Anyone?

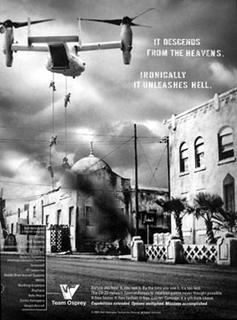

Sometimes, defense contractors simply bilk the government, a la Halliburton. Other times, they both bilk the government and manage to create offensive advertising at the same time. The recent case of Boeing and Bell provides such a double whammy. The gestation of the V-22 Osprey tilt-rotor aircraft has been long and troubled. 23 Marines have been killed in its development. Also, its history is not marked by cost effectiveness either, to no one's surprise.

Sometimes, defense contractors simply bilk the government, a la Halliburton. Other times, they both bilk the government and manage to create offensive advertising at the same time. The recent case of Boeing and Bell provides such a double whammy. The gestation of the V-22 Osprey tilt-rotor aircraft has been long and troubled. 23 Marines have been killed in its development. Also, its history is not marked by cost effectiveness either, to no one's surprise.It's understandable then that Boeing and Bell were rather ecstatic when the Osprey finally completed its tests successfully and was cleared for full production. Boeing and Bell initially caught flak with running the pictured ad a month ago in the Armed Forces Journal. Not wising up, they then ran the very same ad just last week in the National Journal--by mistake, or so they claim. The Council on American-Islamic Relations (CAIR) was offended by the image of "hell" being a mosque coming under siege, presumably by American troops from "heaven". Of course, this sort of thing is excellent fodder for jihadists--American companies reaping profits by blowing up mosques appears to be the perfect recruitment tool. Will the tilt-rotor aircraft revolutionize fighting as its proponents claim? Well, it may be the case that it first manages to revolutionize young Islamic men into becoming fighters.

Wednesday, October 05, 2005

"You're Doing a Good Job, Greenie"

With the Fed putting the pedal to the metal, damn everything else, the stock markets aren't exactly prospering at the moment. The DJIA is down over 210 points over the past two days, and the Nasdaq isn't doing any better. I noted a while back that the Fed would continue on its "measured pace" of 25 bp hikes if it was serious about controlling asset price bubbles, regardless of the consequences. Indeed, it's a bitter pill to swallow courtesy of Greenspan and friends, but it's necessary in order to regain a measure of sanity. That is, it's better to reduce consumer dissavings and speculation in property markets than risk possibilities like a one trillion dollar current account deficit in 2006 and mass personal bankruptcies reminiscent of the S&L debacle. (On second thought, scratch the latter: it's likely to happen anyhow.)

With the Fed putting the pedal to the metal, damn everything else, the stock markets aren't exactly prospering at the moment. The DJIA is down over 210 points over the past two days, and the Nasdaq isn't doing any better. I noted a while back that the Fed would continue on its "measured pace" of 25 bp hikes if it was serious about controlling asset price bubbles, regardless of the consequences. Indeed, it's a bitter pill to swallow courtesy of Greenspan and friends, but it's necessary in order to regain a measure of sanity. That is, it's better to reduce consumer dissavings and speculation in property markets than risk possibilities like a one trillion dollar current account deficit in 2006 and mass personal bankruptcies reminiscent of the S&L debacle. (On second thought, scratch the latter: it's likely to happen anyhow.)What's evident now is the flimsiness of the so-called recovery post-9/11, fuelled as it is by relatively unproductive pursuits such as consumerism gone wild and housing mania. As the Fed ratchets up rates, consumers have hit a wall, and housing has suffered from the prospect of consumers facing significantly bigger monthly payments and stagnant to falling house prices. As many have pointed out, consumption and construction are pursuits that basically do nothing to narrow the current account deficit and are instead drivers of further widening. Why Greenspan waited this long to douse everything with cold water is beyond me. So much for"The Wizard of Bubbleland" retiring on a high note. This tightening cycle should have begun long ago, and if it did, the results wouldn't have been as spectacularly explosive as we're likely to see.

Friday, September 30, 2005

The Big Bad Wolf Economy

Lafferite supply-side "deficits don't matter" voodoo Reaganomics is having its comeuppance right about now, no matter what lead cheerleader Ben Bernanke has to say. For a second consecutive month (after saving basically nothing before that), American consumers dipped into their microscopic savings to spend themselves silly. A troika of bad news then: personal income and personal spending went down while personal savings "improved" to -0.7% from a revised -1.1%. Calculated Risk hit the nail on the head when he said that Hurricanes Rita and Katrina are not responsible for the most part for this slowdown; rather, it seems that a perfect storm was already gathering in the form of "soaring gas prices, nightmarish home-heating costs this winter, plunging consumer confidence, rising interest rates and falling new-home sales".

Lafferite supply-side "deficits don't matter" voodoo Reaganomics is having its comeuppance right about now, no matter what lead cheerleader Ben Bernanke has to say. For a second consecutive month (after saving basically nothing before that), American consumers dipped into their microscopic savings to spend themselves silly. A troika of bad news then: personal income and personal spending went down while personal savings "improved" to -0.7% from a revised -1.1%. Calculated Risk hit the nail on the head when he said that Hurricanes Rita and Katrina are not responsible for the most part for this slowdown; rather, it seems that a perfect storm was already gathering in the form of "soaring gas prices, nightmarish home-heating costs this winter, plunging consumer confidence, rising interest rates and falling new-home sales".How much lower can Bush's little girlie man approval ratings get if a full-blown slowdown takes hold? Will the Fed start cutting interest rates again till they reach one percent? Will the dollar finally become toilet paper as the pundits have predicted for so long? As the Chinese curse says, "May you live in interesting times".

Monday, September 26, 2005

Chrysler Contracts GMitis

No sooner had the ink dried on my previous post lambasting GM's questionable decision to stake its future on more blubberly SUVs did Chrysler decide to do the same. For someone who's already said to himself that his next car will probably run on alternative fuel, I cannot fathom this decision at all. Chrysler has done pretty well lately on the strength of traditionally configured, ahem, automobiles like the Chrysler 300C, Dodge Magnum, and Dodge Charger. I think they are deriving the wrong conclusions from this success. Instead of thinking, "You know what, we need to provide more non-SUVs that appeal to consumers", they've gone down the path of "Yeah, these current vehicles are successful because of their huge engines, so let's stuff more of those into new SUVs."

No sooner had the ink dried on my previous post lambasting GM's questionable decision to stake its future on more blubberly SUVs did Chrysler decide to do the same. For someone who's already said to himself that his next car will probably run on alternative fuel, I cannot fathom this decision at all. Chrysler has done pretty well lately on the strength of traditionally configured, ahem, automobiles like the Chrysler 300C, Dodge Magnum, and Dodge Charger. I think they are deriving the wrong conclusions from this success. Instead of thinking, "You know what, we need to provide more non-SUVs that appeal to consumers", they've gone down the path of "Yeah, these current vehicles are successful because of their huge engines, so let's stuff more of those into new SUVs."

Chrysler's sales pitch is that these new models are more fuel efficient compared to full-sized (-fat?) SUVs, of which it is only introducing one among (count 'em!) five various models. The problem, of course, is that their mileage is, in turn, not as good as that of sedans or station wagons. One hopes that Chrysler will have a good outcome here, but they're definitely not filling a demand for more frugal vehicles, no matter how they try to spin the matter. If even gas lubber extraordinare Bush Jr. calls for fuel conservation, why can't automakers wean themselves off SUVs?

Wednesday, September 21, 2005

GM Stares Into the Abyss

On top of everything, domestic automakers have trained SUV buyers to expect sizeable discounts and consider sticker prices as a running gag. Vastly improved they may be, but I doubt whether GM's belief in these vehicles' superiority will be so pronounced as to warrant holding back from more "Employee Discounts". Once you frame expectations among consumers, they are difficult to remove. What's the score, then? GM's market value is less than that of its cash holdings, its bonds are garbage, and its parts supplier, Delphi, is on the brink of bankruptcy. The US government bailed out Chrysler long ago, but it might not have the wherewithal of doing so for GM since it's incredibly strapped already from activities like keeping afloat the airline industry and its sundry underfunded pensions. GM would break the public finances for good.

For all the similar difficulties it's facing, Ford is at least making a concerted effort to reorient its product line towards alternative energy vehicles. Unless GM comes up with better ideas than "saving" itself with a new line of hulking SUVs, this General might soon be consigned to the trash bin of history.

Sunday, September 18, 2005

Halliburton Perversion and Reconstruction

The beauties of being a heavily-favored contractor include getting loads of dough without unreasonable demands such as fulfilling contracts and being accountable. I have neglected to follow the path of Halliburton's stock price in the past few months until compelled to do so by the folks over at the Angry Bear blog. Well surprise, surprise. At this same time a year ago Halliburton stock wasn't doing as well despite oil prices starting their ascent, perhaps because of the constant unfavorable attention being shed on its connections with Vice-President Dick Cheney. Yet the election focus wore off as November 2 came and went and the good times rolled on.

The beauties of being a heavily-favored contractor include getting loads of dough without unreasonable demands such as fulfilling contracts and being accountable. I have neglected to follow the path of Halliburton's stock price in the past few months until compelled to do so by the folks over at the Angry Bear blog. Well surprise, surprise. At this same time a year ago Halliburton stock wasn't doing as well despite oil prices starting their ascent, perhaps because of the constant unfavorable attention being shed on its connections with Vice-President Dick Cheney. Yet the election focus wore off as November 2 came and went and the good times rolled on.Bilking the government to the tune of $212 million with little penalty surely helped it when the election spotlight was removed. Plus, in recent times, it has been aided by the quickening pace of oil price increases, which in turn has made demand for oilfield services provided by the company rather high. With the recent cooling down of oil prices, though, some believe that Halliburton won't have it so good. I'm inclined to believe that Halliburton doesn't take such liberties with its private clients, which are less willing to go along with being ripped off as the US government is.

We come full circle to Halliburton circa September 2005. Despite some cooling off in oil prices, which may crimp private sector business, Halliburton is still powering ahead courtesy of taxpayer dollars. Because of its excellent, cost-effective reconstruction work in Iraq, the US government now sees fit to award its favored contractor with more reconstruction work in affected gulf coast areas. The moral of the story: there is none. The opportunist that I am, I thought, "Hey, maybe it's time to get on the Cheney Gravy Train", but no. Sure the stock has doubled in price over the past 12 months, but it appears that the natives are restless. With the spotlight back on Halliburton taking liberties with public funds, Election 2004-style negative press probably will remove some of the stock's buoyancy. It was a good ride for those who bought HAL a year ago at something like $32 while it's now $65. With a business model this good--results are optional in the public sector--the stock was bound to come up.

Friday, September 16, 2005

Mercedes in Hades

A few days back, I got a brochure from the local Mercedes dealer notifying that the latest iteration of Benz’s flagship model, the S-Class, was to be unveiled soon. Whereas in the past such an announcement would have brought great excitement, I approach the current one with trepidation. Simply put, Mercedes doesn’t make them like they used to. M-B is making some pretty big claims about its new car. However, the recent history of M-B’s products has been troubled, making many loyal customers second guess the make. Basically, Mercedes-Benz is now more marketing-led (in the pejorative sense) than engineering-driven. Back in the day, it was said that M-B’s engineers designed the best car they could, then had the bean counters determine its price afterwards. Nowadays, it can be said that the brand has been diluted by a proliferation of too many models as dictated by marketing-led whims, leading to resources spread too thin to ensure uniformly good products. Keeping these thoughts in mind, here are the resulting gripes, all of which are common and valid in my experience:

A few days back, I got a brochure from the local Mercedes dealer notifying that the latest iteration of Benz’s flagship model, the S-Class, was to be unveiled soon. Whereas in the past such an announcement would have brought great excitement, I approach the current one with trepidation. Simply put, Mercedes doesn’t make them like they used to. M-B is making some pretty big claims about its new car. However, the recent history of M-B’s products has been troubled, making many loyal customers second guess the make. Basically, Mercedes-Benz is now more marketing-led (in the pejorative sense) than engineering-driven. Back in the day, it was said that M-B’s engineers designed the best car they could, then had the bean counters determine its price afterwards. Nowadays, it can be said that the brand has been diluted by a proliferation of too many models as dictated by marketing-led whims, leading to resources spread too thin to ensure uniformly good products. Keeping these thoughts in mind, here are the resulting gripes, all of which are common and valid in my experience:(1) Mercedes-Benzes break down all the time – Once upon a time, Mercedes was a paragon of engineering excellence and product reliability. It used to be among those makes that garnered the fewest defects in the JD Power survey. Nowadays, its models are nowhere near that level, and many M-B models are now among the most recalcitrant luxury cars according to Forbes. If you ask me, it’s due to overloading the cars with electronics which are more prone to technical glitches. Mechanical solutions seem to have elegance often absent in electronic ones. Instead of designing cars right that have desirable characteristics—predictable handling, moderate weight, good front-rear weight distribution, etc.—Mercedes now tries to correct fundamental design weaknesses by festooning their cars with an alphabet soup of electronic aids. The end result is that they pile on more electronics that have the unfortunate tendency to initiate electro-Chernobyl.

(2) Mercedes-Benzes look kind of funny – A Mercedes used to look like the business, as in “Don’t bother me, I’m a third-world despot who’ll dispossess your entire family at a whim” or “Out of my way, little man, I need to engineer mega-deals that keep the world running”. Nowadays, the messages it sends are more along the lines of “Hey mister, do you want to play miniature golf?” and “The Liberace was a style pioneer”. Tasteful conservative styling has been thrown out the window in favor of faddish styling that probably won’t age well. The main offender is the CLS, a.k.a. “The Banana Car” and the “Venga-Benz”. Despite its size, this big-ass car has virtually no rear headroom because its back windshield slopes down at an extreme angle in the name of style. Even the aforementioned S-Class looks ugly according to CAR Magazine, with its exaggerated Hummer-inspired fenders and BMW-inspired bubble butt. Such offenses would have been grounds for excommunication in the not-so-distant past.

(2) Mercedes-Benzes look kind of funny – A Mercedes used to look like the business, as in “Don’t bother me, I’m a third-world despot who’ll dispossess your entire family at a whim” or “Out of my way, little man, I need to engineer mega-deals that keep the world running”. Nowadays, the messages it sends are more along the lines of “Hey mister, do you want to play miniature golf?” and “The Liberace was a style pioneer”. Tasteful conservative styling has been thrown out the window in favor of faddish styling that probably won’t age well. The main offender is the CLS, a.k.a. “The Banana Car” and the “Venga-Benz”. Despite its size, this big-ass car has virtually no rear headroom because its back windshield slopes down at an extreme angle in the name of style. Even the aforementioned S-Class looks ugly according to CAR Magazine, with its exaggerated Hummer-inspired fenders and BMW-inspired bubble butt. Such offenses would have been grounds for excommunication in the not-so-distant past.(3) Mercedes-Benzes have cheap interiors – M-B cars aren’t cheap, but their interiors often are. I swear, the passenger compartment of my previous-generation Volkswagen Passat was noticeably better furnished than that of the last generation S-Class. Hard, shiny plastics, leatherette-like leather, and squeaks and rattles aplenty marred the Benz’s interior. The first iteration of the ML class marked the nadir of M-B interiors. The car magazines I’ve read say that the newer models have nicer interiors, but are by no means on par with those of VW-Audi products. Mercedes has some way to go before it regains more respect in this area.

So, it’s good to know that Mercedes-Benz’ top brass is well aware of this sorry situation by making CEO Dieter Zetsche, formerly the caretaker of better-running Chrysler, the overseer of Mercedes-Benz. Will more buyers still flock to the three-pointed star despite its faded glory? I hope to get a better indication as the newly launched models become available for testing. Until then, it might be advisable to let the German engineers iron out their quality control issues before taking the plunge again.

Blogging Hardware Update

I’m back to my occasional hobby of blogging Bloomberg after a short sabbatical. I’m moving from my after-hours workstation pictured here, where I monitor Bloomberg like a hawk, to more northerly climes. So, it’s ta-ta for now to my usual equipment, an Acer laptop and a TCL television. The Acer is well-equipped but heavy, while the TCL—made by the world’s largest television maker—has a big screen but so-so picture quality. Still, it had a good price, well under half that of a Sony CRT unit.

I’m back to my occasional hobby of blogging Bloomberg after a short sabbatical. I’m moving from my after-hours workstation pictured here, where I monitor Bloomberg like a hawk, to more northerly climes. So, it’s ta-ta for now to my usual equipment, an Acer laptop and a TCL television. The Acer is well-equipped but heavy, while the TCL—made by the world’s largest television maker—has a big screen but so-so picture quality. Still, it had a good price, well under half that of a Sony CRT unit.I’m going back to my usual travel companion, my Lenovo, er, IBM ThinkPad A22M. I bought this unit in 2001 and its Pentium III 1.0 GHz is still going strong. Its battery life isn’t what it used to be, and it wasn’t all that great to begin with. Still, the unit’s light weight and top-class keyboard still make it a joy to use. A problem arises in that I have only one USB 1.1 (old standard) port for an iPod Mini, Viper internet phone, PQI USB drive and Okion Mobix mouse. I’ve partly solved the problem with the mouse by using a PS2 adapter, leaving me with “only” three USB devices vying for one port! I feel that I’ll manage, though. In particular, the mouse is really cute, about ¼ the size of a regular Logitech model (see picture).  There are even smaller ones available, but those have touch surfaces when I prefer the tactility of buttons. It only took a minute or two for me to get used to its tiny controls, and it feels like a quality product with its rubberized surface and retractable cord. The accessories are new but the processor’s the same as it was so long ago. I feel blessed to have such hardware available for my blogging activities.

There are even smaller ones available, but those have touch surfaces when I prefer the tactility of buttons. It only took a minute or two for me to get used to its tiny controls, and it feels like a quality product with its rubberized surface and retractable cord. The accessories are new but the processor’s the same as it was so long ago. I feel blessed to have such hardware available for my blogging activities.

Saturday, September 10, 2005

Does Everyone (heart) the Canadian Dollar?

In a related matter, what exactly do they mean when they say that the loonie is a "commodity currency"? I'm grabbing the following charts from a Canadian government site. The printers were remiss in omitting the x-axis labels, but each vertical line represents a year starting with 2000 and ending with 2004 (these are the latest numbers I could find):

Two observations: (1) The Canadian dollar tracks changes in commodity prices quite well. I did a study once back in graduate school correlating the movements of gold and the loonie with those of some commodity indices and found that CAD wasn't far off the pace of gold--a commodity itself! I'd kill to have a Bloomberg machine in front of me right about now to run an update. (2) Roughly 80% of Canada's exports are US bound. The correlation of that country's exports to the US and overall exports is simply breathtaking.

What can we learn here? The Canadian dollar's strength appears to be backed by strong fundamentals. The Canadian economy is running quite well, and commodity prices are skyrocketing. Some danger is on the horizon, though. MG Forex warns that because Canada is heavily dependent on the US as an export market, the CAD could be hurt if Hurricane Katrina slows demand from the US. One could argue the opposite by saying that Canada stands to gain from meeting post-Hurricane Katrina reconstruction material needs such as lumber and steel. However, The Big Picture offers a hilarious caution to those who automatically swallow the notion that reconstruction is a net boost to the US economy.

Nvertheless, I'd wager that the other two commodity currencies--the Australian (AUD) and New Zealand (NZD) dollars--have more to gain against the US dollar at this point, especially after you factor in their higher O/N yields of 5.50 and 6.75% respectively. The loonie is rightly strong, but it's been wandering in overbought territory for quite some time now, particularly if you look at AUD/CAD and NZD/CAD cross-currency pairs.

Thursday, September 08, 2005

Draconian Hovnanian

The US housing market is overripe and bound for a considerable slowdown. Witness one Hovnanian Enterprises, which has lots of activity in New Jersey and more in superhot California and Arizona. Today it sent the whole housing sector kaboodle reeling after announcing lackadaisical earnings and forecasts. Sooner or later, some sense was bound to creep into the real estate market which has owner/renter and income/house price disparities that are nearly beyond belief. Is this the start of rationalization? I think so; current events seem to have put the fear of God into people who spend well beyond their means. I Pulte da fools who Toll all day just to make ends meet paying off loans that KB adjustable rate or interest-only mortgages.

The US housing market is overripe and bound for a considerable slowdown. Witness one Hovnanian Enterprises, which has lots of activity in New Jersey and more in superhot California and Arizona. Today it sent the whole housing sector kaboodle reeling after announcing lackadaisical earnings and forecasts. Sooner or later, some sense was bound to creep into the real estate market which has owner/renter and income/house price disparities that are nearly beyond belief. Is this the start of rationalization? I think so; current events seem to have put the fear of God into people who spend well beyond their means. I Pulte da fools who Toll all day just to make ends meet paying off loans that KB adjustable rate or interest-only mortgages.To reiterate, housing-related jobs have accounted for 40% of jobs created post-recession. If the housing sector stagnates, there's a good chance that more jobs aren't needed in an industry that's just treading water. Hence, even if housing prices don't diminish significantly a la the housing bubble scenario, considerable economic fallout will befall the US economy as a big part of it increasingly dependent on the housing craze peters out. For those who made a killing these past few years, I congratulate you, but all things must come to an end. (PS: Hovnanian common stock's ticker is HOV, so the Yahoo Finance! graphic is a bit misleading.)

Wednesday, September 07, 2005

iBlasphemy

As an owner of an iPod Mini and a 1st generation iMac, I was mightily disappointed when Apple announced that it was abandoning PowerPC chips for (gasp!) Intel processors. All this time, I was duped, I mean, convinced by Apple that Motorola processors were superior to the Wintel empire's. Dvorak was clairvoyant. First came the Mac Mini which was cobbled together with PC parts, and now Apple has gone whole hog and embraced the wretched Pentium peddlers. Don't they have any decency to at least go for AMD chips? [The author feigns righteous indignation by gesticulating wildly.]

As an owner of an iPod Mini and a 1st generation iMac, I was mightily disappointed when Apple announced that it was abandoning PowerPC chips for (gasp!) Intel processors. All this time, I was duped, I mean, convinced by Apple that Motorola processors were superior to the Wintel empire's. Dvorak was clairvoyant. First came the Mac Mini which was cobbled together with PC parts, and now Apple has gone whole hog and embraced the wretched Pentium peddlers. Don't they have any decency to at least go for AMD chips? [The author feigns righteous indignation by gesticulating wildly.]

Along with running Mac OS X, Windows XP installs without hitch on the Intel-based Mac, just as it would on any other PC, and booted without issue when installed on an NTFS-formatted partition.I bring this up as Apple's ticker symbol scrolls by and mocks me by signaling that it's reached an all-time high. So Apple stock is doing well now, but what will happen when consumers learn the truth that newer Apples are nothing but tarted up PCs? Like Pixar and its slump in DVD sales, Apple is likely to be Jobs' next comeuppance if he doesn't figure out how to differentiate his machines better, perhaps by running Itanium chips as Dvorak suggested. My point all along has been, yes, the iPod is a great product, but AAPL is a computer company, not a music company. Treating the computer side like a lesser business might lead to loyal customers fleeing the brand, leaving fickle sorts for whom the iPod is only a passing fancy. And, oh yeah--real Macs use Motorola chips.

South Korea Powers Ahead

The power of branding is something that Korea can teach the world. Just a few years ago, Korean products were el cheapo substitutes for Japanese makes. The Asian financial crisis almost forced Korea's hand, and it took the country a long time to recover. Well, guess what? Korea's most widely watched stock index, the KOSPI, has just reached an all-time high. At a time when the Dow Jones is more like the Down Jones (which I actually saw as a typo on CNN), Korean stocks are powering ahead.

The power of branding is something that Korea can teach the world. Just a few years ago, Korean products were el cheapo substitutes for Japanese makes. The Asian financial crisis almost forced Korea's hand, and it took the country a long time to recover. Well, guess what? Korea's most widely watched stock index, the KOSPI, has just reached an all-time high. At a time when the Dow Jones is more like the Down Jones (which I actually saw as a typo on CNN), Korean stocks are powering ahead.What lies behind this resurgence? The emergence of Korean brands as global ones is definitely a factor. For instance, Samsung's image has been burnished by its range of cool phones, LCD displays, and other state-of-the-art consumer electronics. Nowadays, I and many others regard Samsung as a premium brand and not another also-ran. (LG Electronics isn't far off the pace.) Hyundai is also becoming renowned as a value-for-money make, featuring a range of desirable cars. You would've been considered a cheapskate for buying a Hyundai in the past, yet it's now a perfectly good substitute for Japanese makes. Check out the Hyundai Sonata now and back when it was lumped with the Yugo and tell me that there's no difference.

Also strong are steelmaker POSCO (just in time for China's commodities boom) and Daewoo Shipbuilding (which has benefited from growth in shipping). What do all these companies have in common? They've established brand equity whether they're B2B or B2C firms. Taiwanese firms, many of which make electronics approaching commodity status, would be well-advised to follow the Korean example. Indeed, BenQ is their first major attempt at branding. The future is always uncertain, yet building a good reputation with customers helps in any situation. Let South Korea show us the way.

Tuesday, September 06, 2005

John Berry Riles Markets

Veteran Fed watcher and Bloomberg columnist John Berry has given pause to those expecting Greenspan and Co. to refrain from making an eleventh straight 25 basis point hike in the Fed funds rate. Just as forex and bond traders were pricing in no changes for the month of September and perhaps the rest of the year, Berry's column hit the wires. The market response was immediate. According to Reuters:

Dollar buying perked up late in the Tokyo session on comments by Fed watcher John Berry. His column, in Bloomberg News, said the odds were slightly in favour of the Federal Reserve raising rates by 25 basis points when it meets on Sept. 20.The Euro subsequently dropped a full cent, while the 10-year US Treasury's yield rebounded to 4.06%. We know that Bloomberg covers markets well, but this is an instance when Bloomberg actually moved markets. Whether Berry is right, though, I'm not certain of yet.

Sunday, September 04, 2005

Hurricane Katrina, FEMA, and Clinton

The answer is on page 428 of "My Life", Bill Clinton's autobiography. Speaking about his 1992 campaign in the wake of Hurricane Andrew:

Traditionally, the job of FEMA director was given to a political supporter of the President who wanted some plum position but who had no experience with emergencies. I made a mental note to avoid that mistake if I won. Voters don't choose a President based on how he'll handle disasters, but if they're faced with one, it quickly becomes the most important issue in their lives.The rest is history. Clinton "reformed FEMA so that it was no longer the least popular government agency but the most admired one, thanks to James Lee Witt" (p. 614). "My Life" has been criticized as overlong and under-organized. Maybe so, but every now and again you come across wisdom like this that makes you want to slap your 45 RPM copy of "Glory Days" on the turntable. Make no mistake; despite his failings, Clinton saved a lot of lives by hiring Witt instead of one of his golfing buddies or political donors. Let's hope that Witt's appointment by Governor Blanco helps. It's time to set political favoritism aside and let the best qualified persons do what can be done to save lives.

Thursday, September 01, 2005

It's Worse Than Zero Savings

Sometime ago, I complained that Bloomberg TV omits to mention the incredible plunging household savings rate. Today's most recent report sheds more light on the so-called Goldilocks economy: the savings rate is now at -0.6%. In its inimitable way, MarketWatch publishes top stories in something like 30-point type. Today's headliner--as eye-catchingly distressing as it is--actually understates the manic superconsumption in the US right now. Mark my words: if sanity doesn't take hold among US consumers, a $1 trillion current account deficit in 2006 is a distinct possibility. Bloomberg, please take note and report this figure.

Sometime ago, I complained that Bloomberg TV omits to mention the incredible plunging household savings rate. Today's most recent report sheds more light on the so-called Goldilocks economy: the savings rate is now at -0.6%. In its inimitable way, MarketWatch publishes top stories in something like 30-point type. Today's headliner--as eye-catchingly distressing as it is--actually understates the manic superconsumption in the US right now. Mark my words: if sanity doesn't take hold among US consumers, a $1 trillion current account deficit in 2006 is a distinct possibility. Bloomberg, please take note and report this figure.WHAT'S THE MATTER WITH YOU? DON'T READ BLOGS! BUY STUFF ONLINE! AFTER THAT, HEAD TO THE SHOPPING MALL/AUTO DEALER/LOCAL EATERY AND spend, spend, SPEND! (Just kidding; I'll support the manic overconsumption by buying lots of medication.)

Tuesday, August 30, 2005

Fleckenstein Kicks Greenspan Booty

Now that's more like it! Suzy Assaad is currently interviewing Bill Fleckenstein, who thinks core inflation is a misnomer for there's nothing more core than food and energy. Thus, inflation for him is often understated. Plus, he opines that Alan Greenspan isn't doing anywhere near a good job. Housing, stocks, and bonds are far from promising. For him, basic investments hold little favor. Go for currencies and commodities especially if you're familiar with them. Cool! Like the inimitable Jim Rogers, the iconoclastic Bill Fleckenstein tells it like it is, warts and all. He's not beholden to big business, the government, or anyone else who makes him toe the party line; he goes his own way.

Now that's more like it! Suzy Assaad is currently interviewing Bill Fleckenstein, who thinks core inflation is a misnomer for there's nothing more core than food and energy. Thus, inflation for him is often understated. Plus, he opines that Alan Greenspan isn't doing anywhere near a good job. Housing, stocks, and bonds are far from promising. For him, basic investments hold little favor. Go for currencies and commodities especially if you're familiar with them. Cool! Like the inimitable Jim Rogers, the iconoclastic Bill Fleckenstein tells it like it is, warts and all. He's not beholden to big business, the government, or anyone else who makes him toe the party line; he goes his own way.

Monday, August 29, 2005

A "Fake" OPEC Member?

Political reasons may be part of why Indonesia hasn't been kicked out of OPEC. It's been suggested that OPEC doesn't want to lose the nation for risk of being seen as an "Arab cartel." Even suggestions that Indonesia is playing off OPEC against the US (which dislikes the cartel) in hopes that the former might decide to invest in boosting Indonesia's output again have been mooted in the said article. Nevertheless, given the potential for large-scale turmoil to envelop Indonesia, it'd be wise for their government to consider the long-term implications of its oil policies. Should Indonesia seek to recapitalize the oil industry and become a net exporter of the black stuff again? Are oil subsidies economically feasible, or are they contributing to the current rupiah devaluation? Time is ticking away.

UPDATE: The central bank of Indonesia has upped its O/N rate by 75 basis points to 9.5% and is selling off dollar reserves to defend the rupiah's value. Shades of 1997: it's flashback time. I just might start playing some "Savage Garden" records. Truly, madly, deeply do.